Following a very challenging year, investors might be considering whether they would benefit from active investment management in 2023 or if they should follow a passive investment strategy through an index tracker.

There’s no right or wrong approach, but it’s important to understand the differences to make an informed decision.

Under the hood

Passive is often seen as a “default option” with lower fees and greater certainty on relative outcome. But the passive universe still comes with choices. ‘Which benchmark would you like to track?’ ‘How closely does the fund track this benchmark?’ ‘Does the fund fully replicate the index?’ ‘What’s the stock lending policy?’ These are just some of the questions we consider when we’re building Parmenion’s Passive solutions.

Active management needs far more detailed analysis. We meet all our active managers at least once a year to undertake full due diligence on their strategy. Active managers invest in a subset of companies within an index, so you could assume that active funds are less diversified than passive, and therefore more volatile. That’s why we dig deeper to identify what risk controls are in place, and how diversified a portfolio is (by industry or country, for example) to help mitigate stock concentration risks.

We also blend different active funds to offset their biases, sometimes resulting in greater diversification and lower volatility than index trackers. Even an index with hundreds of companies can be concentrated by weight, with just a handful of the top 10 driving returns. US equities are dominated by the tech sector, and UK equities have a high concentration to the energy sector. These are just two examples of a potential lack of diversification for passive investors. As of 30 December 2022, just 5 stocks in the FTSE 100 account for over 30% of the index.

Go with the flow?

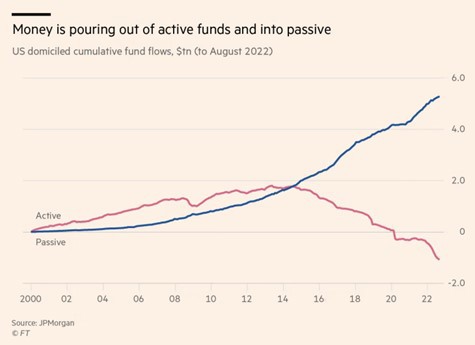

Active managers can navigate the diversification of risks, so we expect more from them to justify higher fees. It’s been difficult to outperform index trackers in recent years, with the majority of investor flows moving into passive instruments – particularly in the US, as you can see in the chart below.

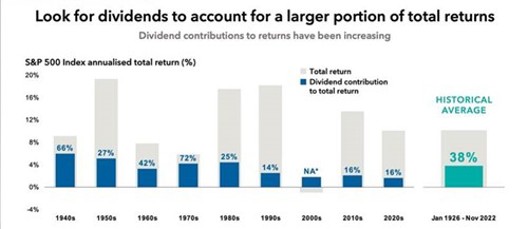

You can see in the chart below that since 2010, the dividend contribution to the S&P 500’s total return averaged just 16%, compared to the historical average of 38%. You could argue that, in an era of close-to-zero interest rates, these flows were the primary driver of returns. With tighter financial conditions beginning to impact ongoing flows, and rates and dividends now at far higher levels, in my opinion we could expect the proportions of returns to shift back towards that historical average.

Sources: S&P Dow Jones Indices LLC via Capital Economics .

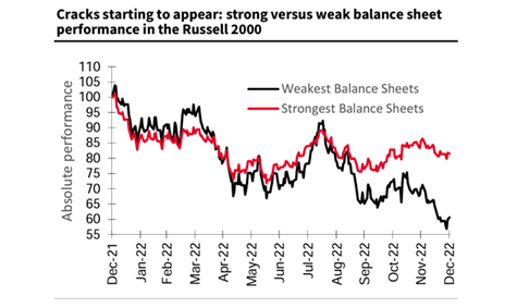

In this environment, you’d expect an active manager to add value, as the opportunity for stock picking becomes more attractive. A passive manager has no scope to avoid exposure to companies at risk of weaker earnings or even insolvency. An example of how fundamentals can impact performance can be seen in the Russell 2000 chart below. Companies with stronger balance sheets have shown greater resilience towards the end of 2022, suggesting they’re better placed to weather the weaker economic environment of higher interest rates and costs.

Source: Bloomberg.

Passive funds are regularly rebalanced, so if this trend continues, they’ll eventually reposition to a greater weighting to companies with strong fundamentals. But we should be aware of a possible change in dynamics. UK investors withdrew £4.5bn net from passive equity funds in 2022 (1), while passive inflows at a global level continued. If the UK trend spreads globally, passive could start to follow the market rather than lead.

Over time, the demand for active and passive investments will ebb and flow, with strong ideological positions supporting either approach. At Parmenion, we recognise the need for active investment and passive investment options and offer a choice between both, or indeed a blend of both through tactical switches between active and passive funds.

(1) trustnet.com/news/13353540/calastone-uk-equity-funds-report-net-outflows-for-second-year-running

This article is for financial professionals only. Any information contained within is of a general nature and should not be construed as a form of personal recommendation or financial advice. Nor is the information to be considered an offer or solicitation to deal in any financial instrument or to engage in any investment service or activity.

Parmenion accepts no duty of care or liability for loss arising from any person acting, or refraining from acting, as a result of any information contained within this article. All investment carries risk. The value of investments, and the income from them, can go down as well as up and investors may get back less than they put in. Past performance is not a reliable indicator of future returns.