My daughter’s recent history project on how fashion styles have changed over the decades got me thinking about the different styles of investing and the pros and cons in chasing the latest style.

Over time, markets go through a variety of cycles. Value dominates in one era, followed by growth in the next. Then there’s ESG investing, and opportunities like small and mid-cap stocks to add to the mix.

In this fast-moving, tech-driven world, it’s hard to imagine any type of investment other than ‘growth’ being successful. But we’re heading into a more normal economic environment, one that we haven’t seen in many years. Gone are the days of zero inflation and interest rates. The question to ask now is this: will the rotation back into value investing prove to be a fad - or a genuine investment opportunity?

A value resurgence

The value resurgence began in November 2020 with the rollout of the Covid vaccine, followed by the gradual reopening of economies. This led to a combination of supply side shocks and pent-up demand from consumers which sparked the first signs of inflation in a very long time.

In 2021, value and growth styles both did well in fits and starts, but it was the Russia/Ukraine war in February 2022 that really put the momentum behind inflation. Energy and food prices rose to levels that made central banks uncomfortable, and higher interest rates to tame inflation were inevitable. With that, the economic cycle we were used to in the 1980s, 1990s and early 2000s returned, as did the environment for value investing.

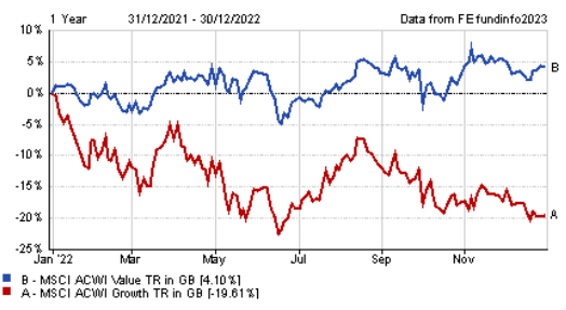

By all accounts, 2022 was a dismal year for both equity and bond markets. But looking at the chart below, you can see an investor in the MSCI World Value Index would have been one of few to have made a positive total return. In relative terms, value outperformed growth by a staggering 23.71%. An economic environment with healthy levels of inflation and interest rates lends itself to value investing. If we stay in that environment for some years, it is likely that value investing could do well.

Source: FE Analytics, 1/12/2021 to 30/12/2022

What does this mean for growth?

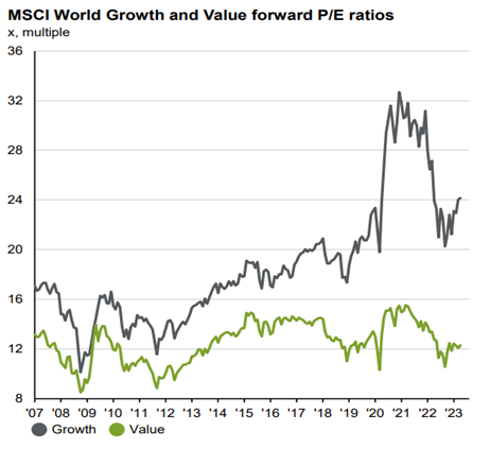

Growth stocks struggle in an environment of higher interest rates as the cost of capital for investment becomes more expensive. Higher interest rates make the future growth of a business more difficult to value as it’s harder to predict earnings. This lack of visibility typically leads to a derating of growth stocks. However, as the chart below shows, the derating has some way to go. Valuations of growth stocks continue to remain elevated.

Source: MSCI, JP Morgan AM, Refinitiv Datastream, to 30/04/2023

It could be argued that the current environment is a temporary dip, and some growth stocks deserve their premium because ultimately, they’ll grow their earnings faster than the market over the longer term.

There are pros and cons to each case. While growth may have struggled recently, it’s worth noting that interest rates might be near their peak. This means the outlook for growth should improve looking ahead as expectations are for a fall in interest rates over the coming year, especially in the US. But as inflation and interest rates are unlikely to fall to zero (unless we experience another shock) the outlook for value also remains positive.

Tortoise versus the hare

So, the real question is not about style investing being a fad or fashion, but how investors can capture opportunities without missing the highs and lows of each. This is exactly how we strive to build portfolios.

We start with a risk framework and build our way up to form portfolios where we can blend different styles while diversifying across other factors such as large, mid and small caps. In our bond portfolios, there’ll be funds with a mix of global government bond exposures, investment grade credits and high yield, while also monitoring duration in a changing interest rate world.

We’re not interested in investments that go up a lot one day and down a lot the next. We prefer the tortoise’s slow, steady pace delivering consistent, incremental growth in our portfolios. By doing this, we can manage the downside risks and the expectations of investors, while aiming to deliver consistent returns.

This article is for financial professionals only. Any information contained within is of a general nature and should not be construed as a form of personal recommendation or financial advice. Nor is the information to be considered an offer or solicitation to deal in any financial instrument or to engage in any investment service or activity.

Parmenion accepts no duty of care or liability for loss arising from any person acting, or refraining from acting, as a result of any information contained within this article. All investment carries risk. The value of investments, and the income from them, can go down as well as up and investors may get back less than they put in. Past performance is not a reliable indicator of future returns.