The much-anticipated Sustainability Disclosure Requirements (SDR) policy statement is here, bringing with it new rules around greenwashing and fund labelling.

What’s the purpose of SDR?

The FCA wants retail consumers to be able to make informed decisions, so (following suggestions from businesses across the industry, including Parmenion) the new rules should give consumers more transparent and consistent information around sustainability.

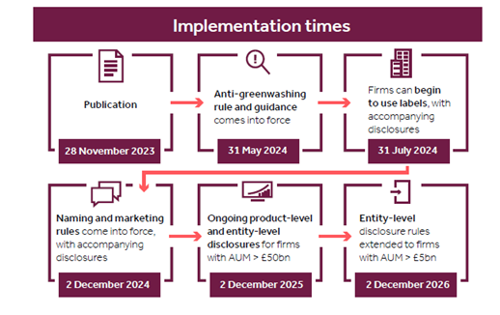

The anti-greenwashing rules will come into play from 31st May 2024, and UK funds can start using the new sustainability labels from 31st July 2024.

What's changing?

- A new working group

So that advisers can continue in their role of supporting consumers make informed choices, a new independent working group is being set up to help the industry share expertise on sustainable finance, as well as how the SDR and the labels can support them.

- An extra "Sustainability Mixed Goals" label

At the moment, there are three labels for ESG/sustainable investment funds:

- Sustainability focus – funds investing in environmentally and/or socially sustainable assets

- Sustainability improvers – funds investing to improve the environmental and/or social sustainability of assets over time, including the stewardship influence of the investment management firm

- Sustainability impact – funds investing in solutions to environmental and/or social problems, making a positive, real‑world impact

A fourth category – Sustainability Mixed Goals – will allow for investing across a combination of the current three.

Although this will help managers of mixed asset funds (who maybe wouldn’t have been able to fully align to one of the other categories), there’s a risk it could become a ‘catch-all’ for products without a clear sustainability purpose. This could end up going against the FCA’s goal of transparency.

- Moving from sustainable to sustainability

The FCA is tweaking the names of their labels from sustainable to sustainability, to better reflect a broader approach to investment. ‘Sustainable’ implies all assets are expected to be fully sustainable, while ‘sustainability’ gives more room for investors being on an investment journey.

- Giving a more inclusive meaning to 'Impact' investing

While the basic definition of Impact investing hasn’t changed since the FCA’s initial drafting (investing in solutions to problems affecting people and the environment, to achieve real-world impact), the new rules make it clear this isn’t just limited to new private market investments. This will come as a relief to many fund managers looking to promote the positive impact of their portfolios to retail investors.

- Portfolio management consultations

Discretionary wealth managers, or those running portfolios of funds, will have to wait until the FCA completes their new consultation into portfolio management, due to begin in early 2024, to get clarification on their own labelling criteria.

A positive step

This is a very positive first step in UK investment sustainability regulation, especially for retail investors, and we'll continue to work with the FCA as the rules grow and evolve over time.

This article is for financial professionals only. Any information contained within is of a general nature and should not be construed as a form of personal recommendation or financial advice. Nor is the information to be considered an offer or solicitation to deal in any financial instrument or to engage in any investment service or activity.

Parmenion accepts no duty of care or liability for loss arising from any person acting, or refraining from acting, as a result of any information contained within this article. All investment carries risk. The value of investments, and the income from them, can go down as well as up and investors may get back less than they put in. Past performance is not a reliable indicator of future returns.