The past

Economies and financial markets don’t stand still. Investors will experience the occasional bump along the way, probably at times when it’s least expected. Take the Global Financial Crisis (GFC) for example. The major economic shock and upheaval it caused in the financial services sector ultimately led to stringent regulations (particularly in the UK and Europe) - and a prolonged period of ultra loose monetary policy, low interest rates, and low bond yields.

When cash and bonds were paying very little in nominal yields, investors naturally looked for growth elsewhere. Portfolios shifted towards higher growth assets, which in some cases were riskier than before. Despite a positive period for bonds, the low yields on offer meant that exposure to fixed interest fell, arguably resulting in imbalanced portfolios.

Then came 2020 and the global pandemic. The economic cycle was turned on its head and the laws of economics took hold, sparking a change in outlook for many asset classes, particularly bonds.

The present

The Covid pandemic induced a period of dislocation, leading to supply chain bottlenecks across the globe, followed by pent up demand. This all contributed to the economic environment we’re in today – one dominated by higher inflation and higher interest rates.

In such an environment, fixed interest assets have been really challenged. There is an inverse relationship between bonds and interest rates: when interest rates go up, bond prices fall in value and yields rise. As a result, bonds (particularly long dated government bonds which are more sensitive to interest rate rises) had one of the worst years on record in 2022 while central banks focused entirely on taming inflation by raising interest rates.

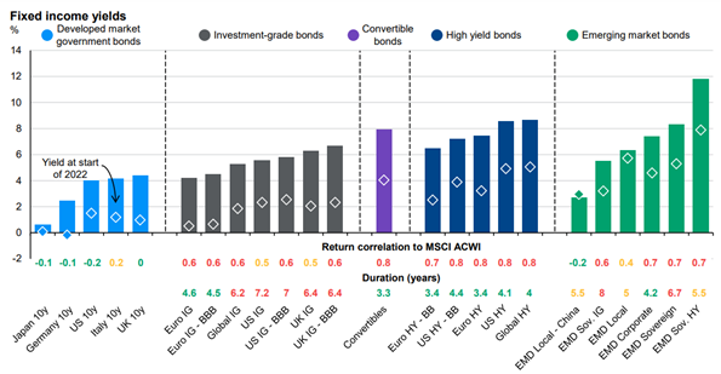

Given where bond yields are today, it would be premature to overlook the asset class, both from an income and total return perspective. The bar chart below shows where current yields are globally in different types of fixed interest assets - the diamonds show where yields were in January 2022.

Source: J P Morgan Asset Management, data at 8th August 2023 .

For example, UK Investment Grade bonds were yielding around 2% in January 2022. Today, they yield upwards of 6%, a significant uplift in income. This means bonds are once again a very attractive asset and have a meaningful place in a diversified portfolio.

The future

If we’d foreseen the extent of central bank rate hikes across the last eighteen months, a global recession would have been high on the cards. Add the pension crisis in the UK last September and the US regional bank crisis in March, and we would have expected central banks to be cutting interest rates by now. A strong labour market and persistent core inflation (although falling slowly) has prevented that.

Interest rates won’t rise forever. The laws of economics will take effect again, and if there’s enough softening in inflation, the rising interest rate cycle in the US could be nearing its end.

We remain reasonably positive in our outlook for fixed interest assets, particularly government bonds, as they can offer some defensive characteristics in an economic downturn. Investment grade bonds are also attractive from a yield perspective, but their spreads have tightened this year so favouring higher quality managers is important. Yields on high yield bonds are also attractive though they’re higher risk, so the impact of a recession on these assets is worth bearing in mind.

We firmly believe that diversified portfolios across a range of assets provides a good balance for investors to achieve attractive risk adjusted returns over the longer term.

This article was first published here by Trustnet.

This article is for financial professionals only. Any information contained within is of a general nature and should not be construed as a form of personal recommendation or financial advice. Nor is the information to be considered an offer or solicitation to deal in any financial instrument or to engage in any investment service or activity.

Parmenion accepts no duty of care or liability for loss arising from any person acting, or refraining from acting, as a result of any information contained within this article. All investment carries risk. The value of investments, and the income from them, can go down as well as up and investors may get back less than they put in. Past performance is not a reliable indicator of future returns.