2025 has been a very strong year for markets. Despite ongoing conflict in Ukraine and the Middle East, renewed tariff tensions following President Trump’s “Liberation Day”, and a growing number of extreme weather events, global equity and bond markets continued to move higher, delivering healthy portfolio returns.

For ESG investors, however, it's been a mixed picture. Sustainable companies generally lagged broader markets over the year. In this update, we reflect on how our Parmenion ESG solutions performed in 2025 and outline why we believe the backdrop for ESG investing is becoming more compelling as we look ahead to 2026.

Our asset allocation added value in 2025

The chart below highlights that after several years of US equity market dominance, 2025 saw performance broaden across regional equity markets. UK equities were the standout, led by the UK Equity Income Index, which gained over 31%, with the FTSE All-Share rising 24%. Europe ex UK, Asia and Emerging Markets also delivered strong returns.

The US market produced a respectable gain of over 9% in sterling terms, but lagged other regions for UK-based investors, largely due to a depreciation of around 7% in the US dollar versus sterling.

Our Parmenion investment solutions have a bias towards UK and Asia and Emerging Markets equities, alongside an underweight to the US. This positioning added meaningful value over 2025 and was a key contributor to returns across our portfolios.

Why ESG lagged despite supportive asset allocation

However, these profitable asset allocation decisions were offset for our ESG solutions because ESG as an investment style was out of favour during 2025, which weighed on ESG portfolio performance. The bar chart below shows the performance of different industrial sectors within global equity markets over the year (measured by the FTSE All World index in sterling terms).

Source: FE analytics, 31 December 2024 to 31 December 2025

At a sector level, metals and mining was the strongest performer globally, rising by around 140%. This is an area where our active ESG solutions have minimal exposure due to environmental and social considerations. Our passive ESG solutions take a more pragmatic approach and do hold limited exposure to mining companies that meet minimum ESG standards.

Alternative (renewable) energy gained 75%, which supported our ESG portfolios. However, sectors excluded by our ESG screening, including defence and tobacco, also performed very well, creating a performance headwind.

Technology stocks outperformed, where our ESG solutions have significant exposure. That said, much of the market’s gains were driven by the so-called “Magnificent 7”, where our ESG portfolios are underweight. This reflects both our lower allocation to US equities and ESG and investment concerns around certain companies. As shown in the table below, our exposure to these stocks remains materially lower than a comparable Morningstar benchmark.

| Mag 7 | Sustainable Growth Risk Grade 6 | Ethical Growth Risk Grade 6 | Screened Growth Risk Grade 6 | Passive ESG Growth Risk Grade 6 | Morningstar UK Moderately Adventurous Target Allocation |

|---|---|---|---|---|---|

| Microsoft | 1.8 | 1.6 | 1.4 | 1.1 | 2.0 |

| Apple | 0.0 | 0.3 | 0.4 | 0.0 | 1.9 |

| Alphabet | 0.5 | 0.3 | 0.2 | 0.0 | 1.4 |

| Amazon | 0.0 | 0.0 | 0.0 | 0.0 | 1.1 |

| Nvidia | 0.9 | 1.1 | 0.8 | 1.2 | 2.2 |

| Meta | 0.0 | 0.0 | 0.0 | 0.0 | 0.8 |

| Tesla | 0.0 | 0.0 | 0.0 | 0.6 | 0.6 |

| Total | 3.2 | 3.3 | 2.8 | 2.9 | 10.0 |

Source: Morningstar as at 30 September 2025

How our portfolios performed

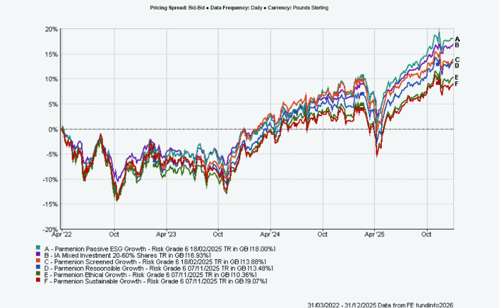

The chart below shows the performance of Risk Grade 6 across our Parmenion ESG solutions in 2025, compared with the IA Mixed Investment 20–60% Shares benchmark. You can also see 3- and 5-year performance charts towards the end of this article.

Over the year, portfolios with the highest ESG standards, including our Sustainable, Ethical and Screened Growth solutions, lagged broader markets. More pragmatic approaches, such as our Passive ESG solution, performed relatively better. Our Responsible Growth solution also followed this pattern and, as previously communicated, will merge into our Sustainable Growth solution in early 2026.

This divergence largely reflects differences in portfolio construction. Our active ESG solutions apply stringent ESG criteria and are fully invested in active funds. By contrast, many peer ESG portfolios blend active funds with passive exposures, which can include limited allocations to areas such as oil and gas, gambling or certain social media companies. In a year when several excluded sectors performed strongly, this higher level of ESG purity created a short-term performance headwind.

Key highlights during 2025

- A 13-year track record: Our active ESG solutions reached their 13-year anniversary in March, providing advisers with a long and robust performance history.

- Ongoing fund research and diversification: Throughout the year, our Ethical Oversight Committee continued detailed ESG due diligence. New additions, including Trium ESG Emissions Improvers, Sparinvest Ethical Global Value, Carmignac Emerging Markets and JPM Emerging Markets ESG, enhanced diversification and outperformed within their asset classes.

- Strong performance from ESG bonds: While ESG equities lagged, our active ESG bond funds outperformed their benchmarks, driven primarily by effective credit selection.

- Passive ESG milestone: Our Passive ESG solution celebrated its three-year anniversary in 2025, delivering above-average performance over the period (1) and growing to over £40m in assets.

- Industry recognition: Parmenion was named Best ESG Provider by Moneyfacts in 2025.

- Consistently high sustainability ratings: Our ESG solutions continue to achieve the maximum 5 out of 5 Morningstar sustainability globes, reflecting our focus on companies with low ESG risk.

Looking ahead to 2026

More supportive ESG sentiment outside the US

While ESG rhetoric in the US has become more challenging, sentiment remains far more constructive across other regions. Our exposure to Asia, particularly China, is benefiting from supportive government policy around green energy, energy efficiency and infrastructure investment. Combined with rapid technological innovation, this is accelerating electrification, digitalisation, and smart grid development.

AI driving demand for renewable energy

Even in the US, the growth of AI is significantly increasing demand for renewable energy, creating strong growth for our portfolio companies. Data centre electricity demand is expected to rise by around 160% by 2030, with roughly 40% expected to be met by renewables. This will require an estimated $700bn of investment in the US electricity grid alone (2).

Corporate commitment remains strong

Although companies may be less vocal about ESG messaging, underlying commitment remains robust. Recent surveys show that 88% of CEOs believe the business case for sustainability is stronger than five years ago, and 99% plan to maintain their sustainability commitments (3).

Record investment into clean technology

Consumer interest continues to grow, with Google search trends for heat pumps, electric vehicles, and solar installations doubling over the past five years. Capital is following demand. Clean energy investment reached a record $2.2trn in 2025, with $2 invested into renewables for every $1 invested in fossil fuels (4).

British public continues to feel strongly about ESG

UK investors continue to care deeply about ESG issues. A recent survey (5) shows:

- 66% are uncomfortable investing in companies that harm the environment

- 80% support investing in renewable energy

- 80% do not want to invest in companies that treat staff or customers badly

- 58% are comfortable investing in environmental solution provider companies

This is reinforced by the FCA’s Financial Lives Survey, which found that 76% of adults with investments or a Defined Contribution (DC) pension believe it is important to be asked about responsible investing preferences.

ESG portfolios provide strong growth, quality metrics, and are relatively attractive

ESG investing has been out of favour for several years, but markets and styles move in cycles. ESG global equities, which traded at an average premium of around 20% three years ago, now trade at a premium of just 4%. At the same time, ESG portfolios continue to demonstrate higher cashflow and long-term earnings growth, alongside comparable quality metrics (6). In our view, this creates a more attractive entry point than we have seen for some time.

Want to hear more?

Sign up to our fortnightly 'ESG insights' newsletter for expert insights – scroll down and use the 'Sign up' button below to receive our updates.

Additional performance charts:

Performance of Parmenion ESG solutions since launch of ESG passive in March 2022:

Five-year performance of Parmenion ESG solutions (excluding Passive ESG):

Sources:

1. Source Parmenion analysis of data from Morningstar Direct. Performance of Parmenion Passive ESG Growth has been compared to a peer group of portfolios achieving the maximum 5 sustainability globes in Morningstar’s model portfolio database over 3 years to December 2025. Risk Grade 3 achieved top quartile performance (ranked 3rd of 31 portfolios within the 20-40% equity category), Risk Grade 6 achieved above median performance (ranked 21st out of 77 portfolios within the 60-80% equity category) and Risk Grade 9 achieved top quartile performance (ranked 8th out of 52 portfolios within the 80%+ equity category).

2. Source – Goldman Sachs Sustainability Insights: 2025 Review.

3. Source - UNGC/PWC CEO Survey 2025

4. Source - International Energy Agency (IEA), October 2025

5. Source – Yougov poll commissioned by UK Sustainable Investment and Finance Association in September 2025.

6. Parmenion analysis based on historical data from Morningstar Direct for HSBC MSCI World Climate Paris Aligned ETF, HSBC MSCI World ETF, Invesco MSCI World ESG Climate Paris Aligned ETF, Invesco MSCI World ETF, iShares MSCI World SRI ETF, iShares MSCI World ETF, UBS MSCI World Socially Responsible ETF and UBS MSCI World ETF.

This article is for financial professionals only. Any information contained within is of a general nature and should not be construed as a form of personal recommendation or financial advice. Nor is the information to be considered an offer or solicitation to deal in any financial instrument or to engage in any investment service or activity.

Parmenion accepts no duty of care or liability for loss arising from any person acting, or refraining from acting, as a result of any information contained within this article. All investment carries risk. The value of investments, and the income from them, can go down as well as up and investors may get back less than they put in. Past performance is not a reliable indicator of future returns.