It’s been a challenging and unnerving time for investors throughout 2022, particularly over the past few weeks. New UK government policies have intensified the range of possible economic outcomes over the near to medium-term, with risk premia – the excess return needed to compensate for increased risk - up significantly, as seen in higher 10 year Gilt yields.

Meanwhile, global government bond yields have trended upwards throughout the year as central banks have tried to re-establish their inflation-fighting credibility.

This has been a painful journey for investors, especially for lower risk grade portfolios where fixed interest weightings tend to be higher. But with higher yields now available, there’s increasing room for future optimism.

Following the sell-off in global government bonds, yields across the curve are now looking increasingly attractive. Medium to long term US Treasury yields are currently in excess of 4% and, assuming 3% long term inflation, allowing for some upward stickiness, could mean a positive real yield of over 1%. This has been unavailable to investors for quite some time, and would help re-establish some of the defensive characteristics of the asset class missing of late, as explained in Investment Director Jasper Thornton-Boelman’s update on fixed interest.

Additionally, with government bond yields now greater than equity earnings yield in the US, and on a par in the UK, the relatively defensive role historically provided by fixed interest to investors may be back in play. To use two well-worn investment acronyms, TINA (there is no alternative) has been replaced by TIAA (there is an alternative).

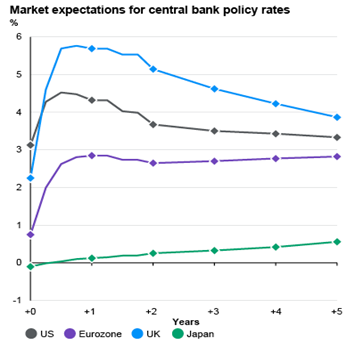

The fixed interest opportunity is not without risk though. While yields have risen meaningfully, central banks remain fixated on getting inflation under control, so additional interest rate rises are widely expected. This now appears largely discounted by the market, with US rates expected to reach over 4.5% by the end of 2022 before peaking late in Q1 2023, and the UK following a similar path but expected to reach over 5.5% later in 2023.

Source: Bloomberg and J.P. Morgan Asset Management.

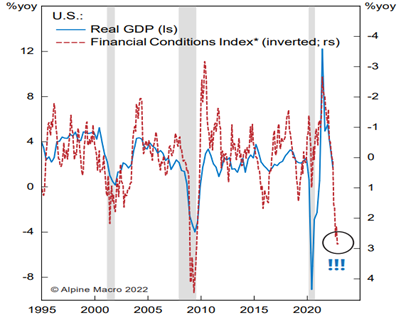

Despite this, tightening financial conditions since the turn of the year mean investors still face headwinds. Historically, this has been a reasonable indicator of future economic activity and, combined with the inversion of yield curves, clearly points to the probability of a marked economic slowdown and recession.

Source: Bloomberg Finance and Alpine Macro

This view is reflected in consensus expectations from economists. They believe we’ll soon be in recession, if we aren’t already, but it’s not expected to be deep or prolonged given the prevailing strength of labour markets and relatively robust corporate and household balance sheets. Clearly risks remain, such as the war in Ukraine and other simmering global geopolitical issues. However, assuming central banks don’t take the bizarre step of killing their economies, it seems a reasonable base case.

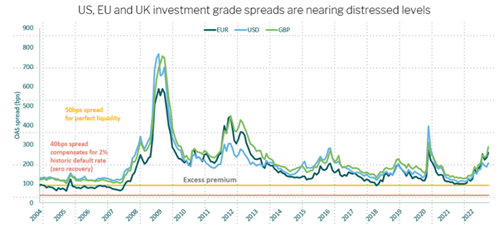

With that backdrop, the recent widening of spreads in both investment grade and high yield corporate bonds means more interesting investment opportunities have begun to emerge. With nominal yields in investment grade bonds now typically in excess of 5-5.5% and those in high yield over 9%, investors can pick up some relatively attractive coupons in real terms. Critically, spreads have notably widened to more than 200bps over the equivalent maturity government bond. And with companies refinancing at much lower rates over the last few years, defaults are expected to remain close to historical averages in the near term. As such, relatively attractive returns appear to be available for the risk incurred.

Source: Bloomberg and M&G

While the picture is reasonably encouraging, the path is expected to remain bumpy into 2023. As Investment Manager Colin Morris explained in our new Parmenion Let's Talk podcast, diversification is the best way of protecting against this whilst capturing upside opportunities.

Remaining patient, long-term and disciplined is arguably more important than ever at this time of heightened volatility. Drawdowns and resets are not necessarily a bad thing - they offer an opportunity from which future returns can be built.

This article is for financial professionals only. Any information contained within is of a general nature and should not be construed as a form of personal recommendation or financial advice. Nor is the information to be considered an offer or solicitation to deal in any financial instrument or to engage in any investment service or activity.

Parmenion accepts no duty of care or liability for loss arising from any person acting, or refraining from acting, as a result of any information contained within this article. All investment carries risk. The value of investments, and the income from them, can go down as well as up and investors may get back less than they put in. Past performance is not a reliable indicator of future returns.