This article was first published on Professional Adviser on 23 April 2024.

A year on from Consumer Duty, we asked Sarah Lyons, our Chief Marketing Officer, how she thinks the new regulation has been embraced by our industry, and what more could be done. Here’s what she had to say:

It’s an interesting premise - a set of rules that aren’t really rules. An expectation of how to conduct business, without a manual telling us what’s right and what’s wrong.

Consumer Duty compels us to conduct our business in the right way. Moving beyond ‘doing things right’ to ‘doing the right thing’, it asks us to question everything through the eyes of the client. And frankly – what’s wrong with that?

Well, one year on from the first deadline and I’m still having frequent conversations with many who think that the Duty is a big fat waste of time. The objection goes ‘but of course we look after our clients’; and ‘of course we deliver value’. This is often accompanied by a real (and frankly, sometimes valid) frustration with the regulator around their own failure to act when customer outcomes are compromised. As someone that got quite close to the British Steel Pension Scheme scandal, I have some sympathy with this view.

It's time to think differently

Yes, the regulator can improve how they operate. But so can we.

Using ‘whataboutery’ to opt out of Consumer Duty doesn’t wash – the evidence that we can do better is everywhere.

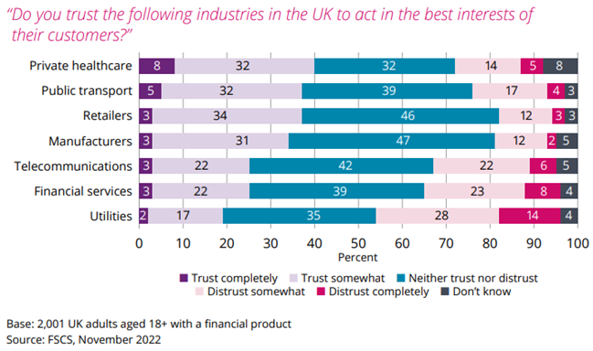

Only 25% of our customers – the ones that invest and pay for all of us –think we act in their best interests, and 31% distrust our communications completely. That puts us in between utility companies and communications companies for trust[1]. If we’re going to have any hope of people engaging with their finances and closing the advice gap, working to improve trust in sector has to be a priority.

There's none so blind as those who refuse to see

Wilful blindness is a human condition that means we avoid hard truths, and actively look for data to confirm our biases, ignoring information that contradicts or challenges us.

I think this is the case for those that say the Duty is a big fat waste of time. The vast majority of UK adults don’t trust financial services, and the only people that can fix that are those who work in the sector. We all have a role to play – it’s not someone else’s problem.

If your firm ticked some boxes for ‘compliance’ with the Duty, that’s all well and good. But what we really need is wholesale cultural change – and that’s hard. It’s why the regulator expects Consumer Duty to take a long time to fully embed.

Have we seen much change?

One year on – have we seen much change? Well, we’re definitely seeing a more stringent approach from the regulator where they think outcomes are compromised. Look through the noise and you’ll see what they really want is a song and dance that align. Often, as a sector, what we say and what we do are two different things. No wonder 75% of consumers say they don’t trust us.

So I say bring it on. I really hope the Duty fulfils its potential - because if it does, the opportunity for all of us is enormous.

[1] FSCS ‘Beyond Compensation’ report May 2023.

This article is for financial professionals only. Any information contained within is of a general nature and should not be construed as a form of personal recommendation or financial advice. Nor is the information to be considered an offer or solicitation to deal in any financial instrument or to engage in any investment service or activity.

Parmenion accepts no duty of care or liability for loss arising from any person acting, or refraining from acting, as a result of any information contained within this article. All investment carries risk. The value of investments, and the income from them, can go down as well as up and investors may get back less than they put in. Past performance is not a reliable indicator of future returns.